Results: It's tax time again! Canadians say they're getting overtaxed and feel they pay too much for the services they get according to a recent poll (Financial Post). Is this a surprise to anyone?

Published on 03/17/2023

Despite rhetoric from left wing parties, top earners pay a large portion of tax revenue, even after trying hard to reduce tax liability. A left wing party leader said recent tax hikes didn't go far enough in "making the rich pay". But how far can hikes go before there is an outflow of business, investment and intellectual talent to countries with better tax policies?

QUESTIONS

GO to COMMENTS

Comments

1.

1.

The top 10% of those who earn over $100,000 per year (in Canada) account for 53% of total individual tax revenue collected by all levels of government. Should they pay even more?

They are not paying enough and can afford to pay more.

22%

490 votes

They are paying too much and their taxes should be lowered.

13%

286 votes

They are paying their fair share.

26%

574 votes

Other (please specify)

1%

28 votes

Not Applicable

39%

852 votes

2.

2.

Taxes are a political and ideological issue in most democracies. In Canada, to account for inflation and other spending, federal income tax brackets have grown from 25% to 33% for those who have incomes over $100,000. There are also local taxes depending on where one lives with sales and other taxes on what one buys with what's left. Have increases in the taxes you pay made it even more difficult to cope with inflation? Is this causing you to spend only on essentials? Are the wealthy also cutting back for the same reasons? Are increasing taxes a problem or a solution?

I can't afford to pay for non-essentials but the rich can and should be able to pay more.

18%

406 votes

I can't afford to pay more but it is the fault of government policies, not the rich.

17%

364 votes

If government learned to spend less and/or manage current revenue better, we all could get a tax cut to help deal with inflation.

26%

567 votes

Other (please specify)

1%

22 votes

Not Applicable

38%

830 votes

I can't afford to pay more but it is the fault of greedy capitalists including the rich.

15%

328 votes

- Carbon taxes, minimum wages, higher taxes on everything, supply chain issues post COVID are the cause.

- not government fault, although I am tired of hearing about ridiculous programs that our money is being spent on - especially since the disabled and sick are living in abject poverty through no fault of their own.

- Capitalists charge too much over and over again. Their profit margin is all they think about

3.

3.

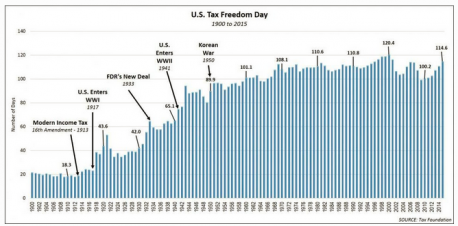

"Tax Freedom Day" is a concept used to calculate the first day of the year on which a nation as a whole has theoretically earned enough total income to generate its total tax revenue. Every dollar of income is counted, and every payment to all levels of government in tax is counted. Then, if average citizens paid all taxes from money earned first before paying themselves, Tax Freedom Day would be the first day in the year they would get to keep the first dollar of earnings for themselves. Which country would you rather live in from the three examples below?

Country "A" has its Tax Freedom Day on April 16th but social programs such as healthcare, pensions and housing are mainly privately funded and paid by individuals. A significant percentage of the population (65%) become homeowners.

10%

210 votes

Country "B" has its Tax Freedom Day on June 14th but healthcare is universal. Pensions and housing are a blend of government and private. A slightly higher percentage of the population (68%) than country "A" become homeowners.

14%

317 votes

Country "C" has its Tax Freedom Day on August 6th and has more extensive government programs than country "B" above with fewer services provided by the private sector. Yet 80% of the population own their homes. The population of Country "C" is #5 in the top 10 happiest countries in the world.

15%

338 votes

Other (please specify)

1%

23 votes

Not Applicable

55%

1201 votes

I could never be happy in a country like "C" where my earnings for 218 days of the year go to pay taxes. I question why they were voted #5 in the world but I will guess in my comments below..

9%

190 votes

- A

- US, Canada, Norway

- USA, Canada, Sweden

4.

4.

The wealthy use strategies to reduce taxes. The media likes to call these "loopholes" implying there is something shady and unethical about them. If not for these deductions, top earners would pay an even higher percentage of tax revenue. As citizens with earned income we have to pay the amount of tax we are obligated to pay - no less than but also no more than that. In law then, the deduction for having children is just as legitimate a deduction as the one for business expenses and both are subject to audit by tax collectors. How do you feel about that?

I hardly pay any taxes yet I am still broke.

12%

264 votes

I earn a good wage but don't have the deductions a business owner with the same income gets. That doesn't seem fair. (comment on why.)

10%

223 votes

I earn a good wage but friends with lower salaries but similar total household income pay less in taxes. That doesn't seem fair. (comment on why.)

8%

168 votes

I earn a good wage but someone earning less than me gets benefits I don't get plus a lower tax rate resulting in a better lifestyle. That doesn't seem fair. (comment on why.)

12%

260 votes

Other (please specify)

3%

68 votes

Not Applicable

59%

1292 votes

- Absolutely - this is a socialist attack on traditional families

- no

- YES!!

5.

5.

Have you been able to guess the countries A, B and C?

Country "C' is Norway. # 5 in happiness. Finland is #1 - why are they so happy?

11%

245 votes

Country "B" is Canada. I guess it could be worse. # 15 in happiness.

19%

423 votes

Country "A" is the USA #19 in happiness. Land of The Free means no free lunch.

17%

369 votes

Other (please specify)

1%

29 votes

Not Applicable

62%

1361 votes

- I don't think so.

- yes

- No

COMMENTS