Results: While older people are often targets for scams, especially online ones, people of all demographics can fall victim to them. Scam artists are very creative but there are red flags to watch out for.

Published on 05/10/2024

Previous surveys have covered some of the scans that specifically target seniors such as the "bank inspector" fraud and the "relative in trouble who needs money wired" scam, but there are others and new ones just over the horizon. There are various ways you can protect yourself. Here are some of them.

QUESTIONS

GO to COMMENTS

Comments

1.

1.

Any investment that offers a rate of return significantly higher than current rates of return on boring everyday investments should raise a red flag and require investigation before providing your personal information. Certainly no money should be sent. One cryptocurrency investment, had a "guaranteed return" of over 100%. What seemed like a no-brainer to a son trying to help his parents turned out to be a nightmare for them. They lost their initial $250 "investment," then their life savings, retirement fund, and an additional $30,000 loan they took out. The son was the "no-brainer." CDs are guaranteed, investments are not. Have you ever invested in something offering more than 10% above what the marketplace was offering and actually got what was promised?

Yes

6%

130 votes

No

52%

1090 votes

Undecided

9%

198 votes

Not Applicable

32%

682 votes

- 9%

- n/a

- 5%

2.

2.

Beware of investments being promoted by close friends or relatives. Real investments have licensing, disclosure, legal documents and other consumer protections behind them. The absence of all this boring paperwork you probably wouldn't read anyway is still a red flag. If your friend or relative hasn't seen and or read these documents the red flag is now a deeper shade. Have you ever invested and made money on something that was recommended by a relative?

Yes

8%

176 votes

No

57%

1196 votes

Undecided

7%

141 votes

Not Applicable

28%

587 votes

- Time share

- n/a

- Like my own research

3.

3.

Beware of investments where the money is being sent overseas. My sister in law made the mistakes in #1 and #2 above plus the money was being sent to an internet bank in Iceland. No "bricks and mortar." She was offered 16% at a time when banks were lending at 6% (always look suspiciously at a return of more than 3% above the lending rate - where does the extra money come from?). Her father invested and then got her and friends and relatives involved. They all lost money as did the economy of Iceland. Did you hear about this banking collapse? https://en.wikipedia.org/wiki/2008%E2%80%932011_Icelandic_financial_crisis

Yes

11%

239 votes

No

59%

1230 votes

Undecided

9%

183 votes

Not Applicable

21%

448 votes

- Not when cdic insured

- No

- n/a

4.

4.

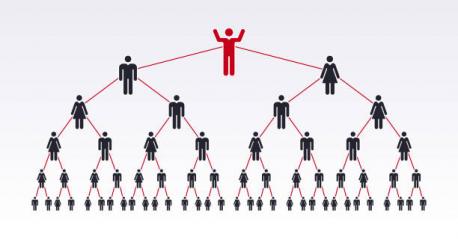

Beware of investments combining the 3 red flags above where you are invited to get in on the ground floor with extra rates of returns offered for early investors. This is the classic sign of a "Ponzi Scheme" where new deposits are used to pay higher returns to those who invested first. The extra money paid is presented as the normal rate of return to induce other investors to come on board. Eventually there are not enough new investors to support the fake returns being paid and the system collapses. Those who get in and get out first make money but the rest lose everything. https://en.wikipedia.org/wiki/Charles_Ponzi Greed is at the heart of most fraudulent investments. If it sounds too good to be true it is. The return OF your money is more important than the return ON your money. Have you ever invested in a Ponzi Scheme?

Yes

9%

180 votes

No

74%

1555 votes

Undecided

17%

365 votes

- yes

- n/a

- Maybe

5.

5.

On December 10, 2008, Bernard Madoff, using Ponzi methods, created one of the most prominent financial firms on Wall Street He was arrested and charged with a single count of securities fraud. Paper losses were estimated to be $65 billion, easily making it the largest fraud in history. Madoff was sentenced to 150 years and died in prison in 2021. Many of his investors committed suicide after being financially ruined. Since 2008 many more such frauds have occurred. Many of the newer ones involve crypto currency investments. Have you invested in crypto currency?

Yes

8%

163 votes

No

71%

1494 votes

Undecided

6%

121 votes

Not Applicable

15%

322 votes

- Attach a 60 lb weight to them that will make them feel like an elderly person.

- death

- Life in prison or beheading.

COMMENTS