Results: Fixing Social Security For Good

Published on 11/17/2025

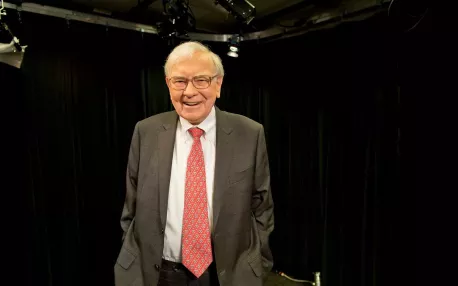

Social Security is the bedrock of American retirement, but its long-term financial health is a persistent concern. As lawmakers debate the future of the program, legendary investor Warren Buffett has offered his characteristically pragmatic and straightforward insights on how to ensure its solvency for generations to come. Known for his no-nonsense approach to complex financial problems, Buffett's suggestions focus on fairness, shared responsibility, and common sense. "Warren Buffett's 4 Ideas to Fix Social Security for Good", Story by

Diego Pérez Morales is the source for this survey.

QUESTIONS

GO to COMMENTS

Comments

1.

1.

Remove the Social Security Maximum Taxable Earnings Cap: One of Buffett's most significant recommendations targets the cap on income subject to Social Security taxes. Currently, workers pay a 6.2% Social Security tax on their earnings, but only up to a certain annual limit. For 2025, this cap is set at $176,100. This means that someone earning $176,100 pays the same dollar amount in Social Security taxes as someone earning $10 million a year. Doing so would mean that high-income earners contribute to Social Security on all of their wages, just as lower and middle-income workers do. Is this a fairer approach in your opinion?

Yes

41%

813 votes

No

12%

238 votes

Undecided

19%

385 votes

Not Applicable

28%

564 votes

2.

2.

Give the Wealthiest Americans Lower Social Security Benefits: In conjunction with having the wealthy pay more into the system, Buffett has also suggested they should receive less from it. He has floated the idea of means-testing benefits, where the wealthiest retirees would receive smaller Social Security checks. The logic is that Social Security was created as a social safety net to prevent poverty among the elderly, not as a supplementary pension for millionaires and billionaires. Would you be in favor of this change to Social Security? Yes

44%

888 votes

No

9%

187 votes

Undecided

18%

358 votes

Not Applicable

28%

567 votes

3.

3.

Gradually Raise the Full Retirement Age (FRA): This is one of the more commonly discussed, and often controversial, solutions to Social Security's funding issues. Buffett has acknowledged the logic behind gradually increasing the full retirement age (FRA), which is currently 67 for those born in 1960 or later. As life expectancies have risen dramatically since Social Security was created, people are living longer and collecting benefits for many more years than originally anticipated. Raising the FRA to 68, 69, or even 70 over several decades would mean people would work longer and contribute more to the system while reducing the total number of years they collect benefits. This would significantly cut the program's long-term costs. The primary objection is that this change would disproportionately affect lower-income workers and those in physically demanding jobs, who may not be able to work longer. Any proposal to raise the FRA would need to be phased in very slowly and potentially include provisions for those who cannot extend their careers. Is this a reasonable change? Yes

22%

442 votes

No

23%

452 votes

Undecided

26%

510 votes

Not Applicable

30%

596 votes

4.

4.

Modestly Increase the Social Security Payroll Tax Rate: While less targeted than his other ideas, Buffett has also acknowledged that a small, across-the-board increase in the payroll tax rate is a viable option. The current rate is 6.2% for employees and 6.2% for employers. A modest increase—for example, to 6.5% or 6.7% over a number of years—would spread the burden of shoring up the system across the entire workforce. While nobody enjoys paying more taxes, a small, incremental increase would be less noticeable in any single paycheck but would collectively generate substantial revenue for the trust funds over time. This approach has the benefit of being simple and broad-based, though it lacks the focus on fairness that characterizes Buffett's other proposals. Would you favor this change?

Yes

29%

573 votes

No

13%

259 votes

Undecided

29%

575 votes

Not Applicable

30%

593 votes

COMMENTS